On October 13, 2021, the Social Security Administration (SSA) officially announced that Social Security recipients will receive a 5.9 percent cost-of-living adjustment (COLA) for 2022, the largest increase in four decades. This adjustment will begin with benefits payable to more than 64 million Social Security beneficiaries in January 2022. Additionally, increased payments to more than 8 million Supplemental Security Income (SSI) beneficiaries will begin on December 31, 2021. (1)

Biggest COLA Increase in Decades?

While many predicted a bump of as much as 6.1% given recent movement in the Consumer Price Index (CPI), the announced 5.9% increase is still substantial. Some fear that rising consumer prices may dilute the impact of the increase with inflation currently running at more than 5 percent. While this remains to be seen, Social Security beneficiaries will no doubt welcome the largest adjustment in many years.1

How You Will Be Notified

According to the Social Security Administration, Social Security and SSI beneficiaries are usually notified about their new benefit amount by mail starting in early December. However, if you’ve set up your SSA online account, you will also be able to view your COLA notice online through your “My Social Security” account. (1)

Next Steps?

If this increase surprises or concerns you, it’s always a good idea to seek guidance from your financial professional about changes to any of your sources of retirement income. I welcome a chance to talk with you about this.

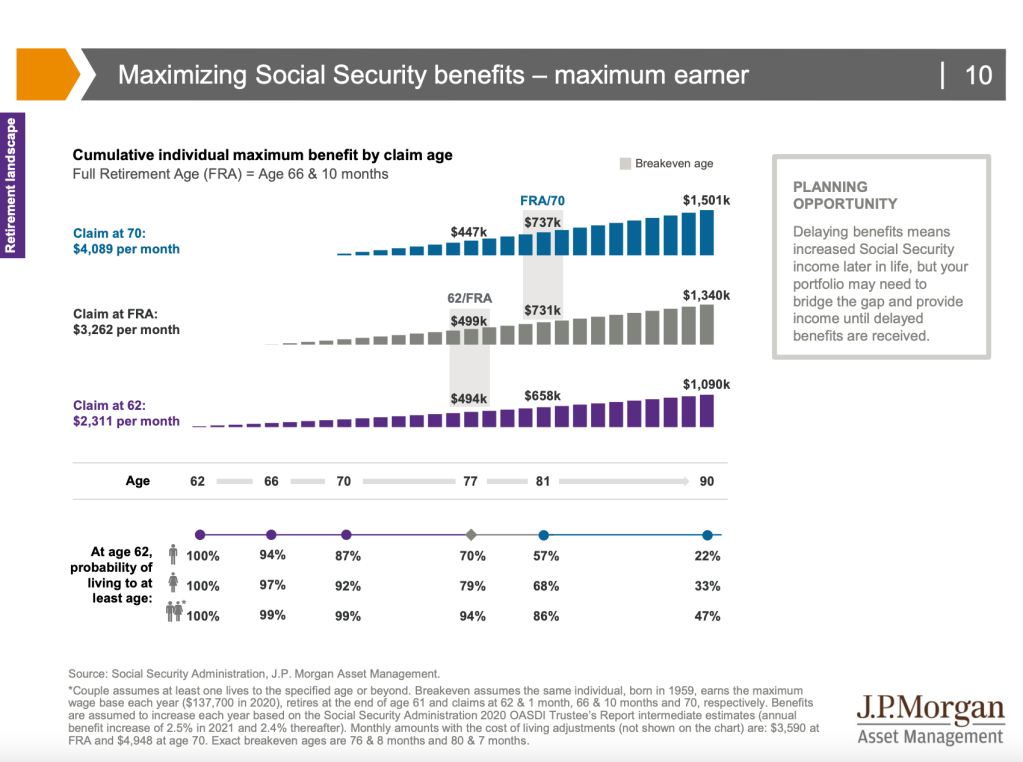

▲ Social Security Timing Tradeoffs

Surprisingly few Americans understand the benefits and trade-offs related to claiming Social Security at various ages. The top graphic illustrates these tradeoffs for people whose Full Retirement Age (FRA) is 66. Delaying benefits results in a much higher benefit amount: Waiting to age 70 results in 32% more in a benefit check than taking benefits at FRA. Likewise, taking benefits early will lower the benefit amount. At age 62, beneficiaries would have received only 75% of what they would get if they waited until age 66. FRA for individuals turning 62 in 2021 is 66 and 10 months, and FRA will continue to move 2 more months in 2022, when it will reach and remain at age 67. The Social Security Amendments Act of 1983 increased FRA from 65 to 67 over a 40-year period. The first phase of transition increased FRA from 65 to 66 for individuals turning 62 between 2000 and 2005. After an 11-year hiatus, the transition from 66 to 67 will complete the move.

The bottom graphic shows the tradeoffs for younger individuals, who will be penalized for early claiming to a greater degree. The percentages shown are “real” amounts – cost-of-living adjustments (COLA) will be added on top, providing an even greater difference between the actual dollar benefits one would receive. The average annual COLA for the past 36 years has been 2.5%.

Sources

- SSA.gov, October 13, 2021

- https://am.jpmorgan.com/us/en/asset-management/protected/adv/insights/retirement-insights/guide-to-retirement/#

This material was prepared by MarketingPro, Inc., and does not necessarily represent the views of the presenting party, nor their affiliates. This information has been derived from sources believed to be accurate. Please note – investing involves risk, and past performance is no guarantee of future results. The publisher is not engaged in rendering legal, accounting or other professional services. If assistance is needed, the reader is advised to engage the services of a competent professional. This information should not be construed as investment, tax or legal advice and may not be relied on for the purpose of avoiding any Federal tax penalty. This is neither a solicitation nor recommendation to purchase or sell any investment or insurance product or service, and should not be relied upon as such. All indices are unmanaged and are not illustrative of any particular investment.