Photo by rawpixel.com on Pexels.com

When stocks soar, fixed-income investments have comparatively little allure.

Investors hungry for double-digit returns may regard them as bland, vanilla securities saddled with an opportunity cost, geared to risk-averse retirees who are “playing not to lose.”

An investment earning a consistent rate of return on a fixed schedule is not a negative. Fixed-income investments are something you may want as part of your portfolio, particularly when stocks fall.

Fixed-income investments have a steadiness that stocks lack.

Most are simple debt instruments: an investor transfers or pays money to a government or financial institution in exchange for a promise of recurring payments and eventual return of principal. (1)

Corporate and government bonds are popular fixed-income investments. U.S. Treasury bills, bonds, and notes, all backed by the federal government, pay interest based on the duration and nature of the security. States and municipalities also issue bonds to generate funds for infrastructure projects. Corporate bonds usually have 10-year or 20-year durations; the interest on them may exceed that of Treasuries and state and muni bonds, but the degree of risk is greater for the bondholder. Firms with subpar credit ratings issue bonds that are junk rated, offering a relatively higher return and higher risk. (1)

There are bond funds that also pay a set rate of return. Some of these funds trade like stocks and can be bought and sold during a trading day, not merely after the close. They typically contain a wide variety of both corporate and government bonds. (2)

Additionally, there are money market funds and money market accounts. They do differ. A money market fund is a managed investment fund made up of assorted fixed-income debt securities. A money market account is simply a high-yield bank account insured by the Federal Deposit Insurance Corporation (FDIC). (3)

Consider certificates of deposit as well. Banks create these debt securities to generate pools of capital to use for their business and personal loans. Some CDs have terms of less than a year; many are multiyear. Typically, the longer the commitment a CD investor makes, the greater the coupon (annual interest rate) on the CD. These investments are FDIC-insured up to $250,000. (1,3)

At some point, you might want less of your portfolio in equities. That realization might be prompted by a consideration of the markets or simply by where you are in life.

When the financial markets turn volatile, the last thing you want is to have all your investments moving in the same direction at the same time.

If your portfolio includes a balance of investments from different asset classes, some with little or no correlation to the stock market, then you may take less of a loss than someone whose portfolio is overloaded in equities.

The risk is, this “someone” could be you. Across a long bull market, the equity investments within your portfolio will usually outgain the non-equity investments. That can throw your original asset allocations out of whack and leave you mostly invested in stocks. If stocks plunge, the value of your portfolio can drop rapidly. (4)

The conventional wisdom is to lessen your equity position as you age. You may currently hold stocks across many sectors of the S&P 500, but that is not diversification. True diversification uses multiple asset classes – and conservative, fixed-income investments – to try to minimize risk.

Fixed-income investments may not always return as spectacularly as equity investments, but they are also less prone to spectacular losses. They are designed to provide some stability for an investor, and as you get older, stability becomes increasingly important.

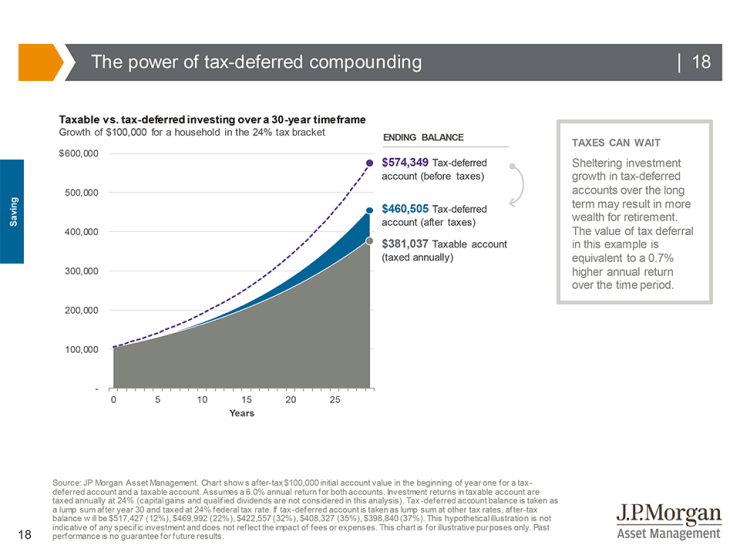

▲ Asset class returns

This chart shows the historical performance and volatility of different asset classes, as well as an annually rebalanced asset allocation portfolio. The asset allocation portfolio incorporates the various asset classes shown in the chart and highlights that balance and diversification can help reduce volatility and enhance returns. (5)

Sources

- thestreet.com/investing/fixed-income/what-is-fixed-income-investment-14758617

- investopedia.com/articles/investing/041615/pros-cons-bond-funds-vs-bond-etfs.asp

- thebalance.com/certificates-of-deposit-versus-money-markets-356054

- fool.com/investing/2018/01/29/heres-how-bull-markets-can-be-bad-for-your-portfol.aspx

- https://am.jpmorgan.com/us/en/asset-management/gim/protected/adv/insights/guide-to-the-markets/viewer

This material was prepared by MarketingPro, Inc., and does not necessarily represent the views of the presenting party, nor their affiliates. This information has been derived from sources believed to be accurate. Please note – investing involves risk, and past performance is no guarantee of future results. The publisher is not engaged in rendering legal, accounting or other professional services. If assistance is needed, the reader is advised to engage the services of a competent professional. This information should not be construed as investment, tax or legal advice and may not be relied on for avoiding any Federal tax penalty. This is neither a solicitation nor recommendation to purchase or sell any investment or insurance product or service, and should not be relied upon as such. All indices are unmanaged and are not illustrative of any particular investment.