Most people worry about not having enough money for retirement. But did you also know that there is such a thing as having too much money? Too much money may not necessarily be a bad thing, but you do need to worry about required minimum distributions (RMDs). Here’s what you need to know about RMDs.

RMDs Depend on Your Age

The main point of RMDs is to keep money from staying tax-free forever. The government gave a temporary tax break to encourage you to save for retirement, but it still wants that tax money. A required minimum distribution is a required withdrawal from your retirement account. It counts in your taxable income just like any other withdrawal in retirement.

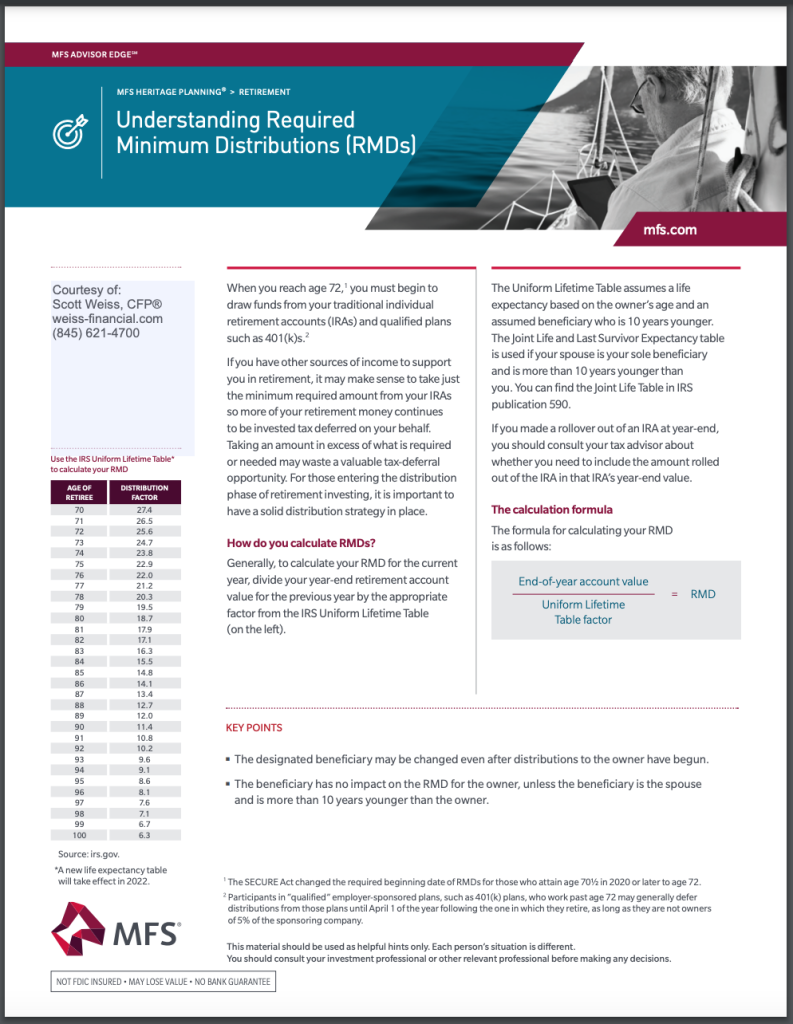

Currently, RMDs start when you hit age 72 (or 70½ if you turned 70½ prior to January 1, 2020) and they are calculated to empty your retirement account within your expected life expectancy. (1) Each year, you need to withdraw a certain percentage of your account with the percentage going up as you age. However, it’s important to realize that you do not have to spend all of this money. You can also reinvest it into a taxable account.

Not Taking the RMD Can Mean Big Penalties

Thinking about skipping RMDs to avoid taxes? Think again. Not only do you still have to pay the taxes on the RMD amount, but you’ll also owe a 50 percent penalty.

For example, if you were supposed to withdraw $10,000 but didn’t, the IRS will charge you an extra $5,000. The penalty repeats every year until you catch up on your RMDs from previous years.

RMDs Can Throw a Wrench in Your Tax Planning

There are many reasons why you might want to reduce your taxable income in retirement. These can include qualifying for things like Medicaid subsidies, avoiding taxes on your Social Security benefits, trying to stay in a lower capital gains tax bracket, or just wanting to pay fewer taxes.

Required minimum distributions can throw a major wrench in your tax planning because not only are they not avoidable, they can suddenly increase if the market surges. If you’re using a tax strategy that requires reducing your income to a certain level, it’s important to build in flexibility for your RMDs.

RMDs Can Be Avoided

There are still ways to reduce or even avoid RMDs altogether. The main idea is to get the money out of your retirement account when you want to not when the IRS wants you to.

One method is to make extra withdrawals at the end of the year. In December, you can estimate your taxes for the year. If you still have room in a lower tax bracket or below the income you need to stay under, you can withdraw additional money. When next year’s RMDs are calculated, it will be on a lower account balance.

You can also convert to a Roth IRA instead of taxing the money out of a tax-advantaged account. Roth IRAs don’t have RMDs because the money has already been taxed. When you make the conversion, you pay ordinary income tax rates on the amount you converted. There are no penalties even if you do the conversion before you turn 59 1/2.

▼ Download

Sources

This content is developed from sources believed to be providing accurate information, and provided by Twenty Over Ten. It may not be used for the purpose of avoiding any federal tax penalties. Please consult legal or tax professionals for specific information regarding your individual situation. The opinions expressed and material provided are for general information, and should not be considered a solicitation for the purchase or sale of any security.