The passing of a loved one irrevocably alters family life. After a death, there is so much to attend to; it is better to do it sooner rather than later. Here, then, is a list of what commonly needs to be looked after.

Request copies of the death certificate.

Depending on where you live, you have two or three places to turn to for this document. You can phone, email, or personally visit the office of the county recorder (or county clerk, as the term may be). Alternately, you can contact your state’s vital records department (sometimes called the state registrar or department of health); it may take a little longer to get the document this way. In addition, some large and mid-sized cities maintain their own registrars of births and deaths.

Call advisors, executors, & business partners as applicable.

The deceased’s lawyer and CPA should be quickly notified along with any business partners and the executor of his or her estate. You must have a say in the decision-making. The tasks of protecting family assets, carrying out your loved one’s bequests, and determining the next steps for a business will follow.

Call your loved one’s current or former employer(s).

Notify them, even if your loved one left the workforce years ago, as retirement savings or pension payments may be involved. As the conversation develops, it is perfectly appropriate to ask about pertinent financial matters – say, 401(k) or 403(b) savings that will be inherited by a beneficiary or what will happen to unused vacation time and/or unpaid bonuses.

Funds amassed in a qualified retirement plan sponsored by an employer (or an IRA, for that matter) commonly go to the primary beneficiary who has been named on the most recent beneficiary form filled out by the account owner. That sounds simple enough – but certain rules and regulations can make things complicated. (1)

As a general rule, if the late 401(k) or 403(b) account owner was your spouse, then you are the presumed beneficiary of the 401(k) or 403(b) assets. Under the Employee Retirement Income Security Act (ERISA), workplace retirement plans are directed to abide by this guideline. If someone else has been named as the primary beneficiary of the account, with your consent, then the assets will go to that person. (2)

If the late 401(k) or 403(b) account owner was single, the assets in the account will go to whomever is designated as the primary beneficiary. The beneficiary designation will override other estate planning documents. (3)

To arrange and confirm the transfer or distribution of such assets, the beneficiary form must be found. If you can’t locate it, the employer and/or the financial firm overseeing the retirement plan should provide access to a copy. The financial firm should ask you to supply:

- A certified copy of the account owner’s death certificate

- A notarized affidavit of domicile (a document certifying his or her place of residence at the time of death)

If you have been widowed, call Social Security.

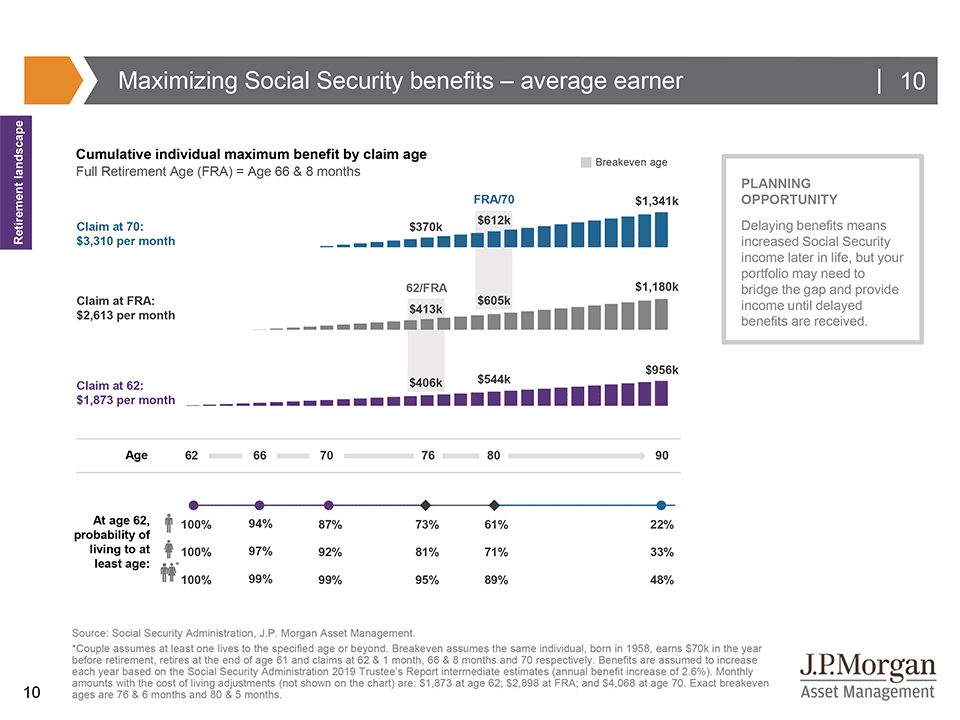

If you already receive benefits, you may now be eligible for greater benefits. (4)

If your spouse received Social Security and you did not, you may now qualify for survivor benefits – and you should let Social Security know as soon as possible, as these benefits may be paid out relative to your application date rather than the date of your loved one’s death. (4)

If this is the case, you may apply for survivor benefits by phone or by visiting a Social Security office. You will need to have some extensive paperwork on hand, specifically:

- Proof of the death (death certificate, funeral home documentation)

- Your late spouse’s Social Security number

- His/her most recent W-2 forms or federal self-employment tax return

- Your own Social Security number & birth certificate

- Social Security numbers & birth certificates of any dependent children

- Your marriage certificate, if you have been widowed

- The name of your bank & the number of your bank account, for direct deposit purposes

If you have reached full retirement age, you will likely get 100% of the basic benefit amount that your late spouse was receiving. If you are in your sixties, but haven’t yet reached full retirement age, you may receive anywhere from 71% to 99% of that amount. If you have a child younger than 16, you will get 75% of your late spouse’s basic benefit amount and so will your child. (4,5)

Contact the insurance company.

Assuming your loved one had some form of life insurance, contact the policyholder services department of that insurer and confirm the steps for claiming the death benefit. A claim form will have to be filled out, signed, and presented to the insurance company (one for each named adult beneficiary of the policy), and a certified copy of the death certificate must also be sent. If the primary beneficiary of a policy is deceased, the contingent beneficiary can usually claim the death benefit with a claim form, plus the death certificates of the policy owner and the primary beneficiary. Some insurers simply have you submit a form reporting the death of the policyholder first, and then follow up by mailing you forms and instructions for the next steps. (6)

Death benefits are generally paid out within 30 to 60 days of a claim. Presumably, they will be paid out in a lump sum. Some insurers will let a beneficiary receive a payout as a stream of monthly income or in installments. (7)

It isn’t unusual for people to own multiple life insurance policies. The AARP, AAA, and myriad banks and non-profits market group life coverage to members/customers, and mortgage lenders and credit issuers offer forms of life insurance for borrowers. Tracking all this coverage down is the problem, and canceled checks and bank records don’t always provide ready clues. Not surprisingly, websites have appeared that will help you search for life insurance policies, and you may be able to locate policies with the help of your state insurance commissioner’s office. (8)

If the family member was a veteran, call the VA.

Your family may be entitled to funeral and burial benefits. In addition, the Veterans Administration offers Death Pensions and Aid & Attendance and Housebound Pensions to lower-income widows of deceased wartime veterans and their unmarried children. (9)

These pensions are needs based. To be eligible for the Death Pension, a widow or child’s “countable” income must fall below a certain yearly limit set by Congress. (A “child” as old as 22 may be eligible for the Death Pension.) The deceased veteran must not have received a dishonorable discharge, and they must have served 90 or more days of active duty, at least 1 day of it during wartime. If they entered active duty after September 7, 1980, then in most cases, 24 months or more of active duty service are necessary for a Death Pension to eventually be paid. The Aid & Attendance and Housebound Pensions provide some recurring income to pay for licensed home health aide or homemaker services. (9)

It is wise to contact a Veterans Services Officer before you file such a pension claim, as they can be a big help during the process. You can find a VSO through your state veterans’ affairs department or through the VFW, the Order of the Purple Heart, the American Legion, or the non-profit National Veterans Foundation. (9)

A final individual income tax return may be required for the deceased.

You or your tax professional should consult I.R.S. Publication 17 for more detail. Also, search for “Topic 356 – Decedents” on the I.R.S. website. Deductible expenses paid by the deceased before death can generally be claimed as deductions on such a return. (10)

If you have been widowed, consider the future.

In the coming days or weeks, you should arrange a meeting to review your retirement planning strategy, and your will, beneficiary designations, and estate plan may also need to be updated. The passing of your spouse may necessitate a new executor for your own estate. Any durable powers of attorney may also need to be revised.

▼ Download

Sources

- thebalance.com/review-401-k-plan-beneficiary-designations-2894174

- nolo.com/legal-encyclopedia/if-you-don-t-want-leave-retirement-accounts-your-spouse.html

- cnbc.com/2018/04/16/out-of-date-beneficiary-designations-are-a-common-and-costly-mistake.html

- thebalance.com/social-security-survivor-benefits-for-a-spouse-2388918

- ssa.gov/planners/survivors/onyourown.html

- nolo.com/legal-encyclopedia/beneficiaries-claim-life-insurance-32433.html

- investopedia.com/articles/personal-finance/121914/life-insurance-policies-how-payouts-work.asp

- thebalance.com/finding-a-lost-life-insurance-policy-4066234

- nvf.org/pensions-for-survivors-of-deceased-wartime-veterans/

- irs.gov/taxtopics/tc356.html

This material was prepared by MarketingPro, Inc., and does not necessarily represent the views of the presenting party, nor their affiliates. This information has been derived from sources believed to be accurate. Please note – investing involves risk, and past performance is no guarantee of future results. The publisher is not engaged in rendering legal, accounting or other professional services. If assistance is needed, the reader is advised to engage the services of a competent professional. This information should not be construed as investment, tax or legal advice and may not be relied on for avoiding any Federal tax penalty. This is neither a solicitation nor recommendation to purchase or sell any investment or insurance product or service, and should not be relied upon as such. All indices are unmanaged and are not illustrative of any particular investment.